Finance Your Sustainable Business with Programs Designed for Clean Energy Success

Specialized loans, government incentives, and green capital for solar installers, EV infrastructure, energy efficiency contractors, and clean tech innovators.

Maximize Capital Efficiency: Combine competitive financing with federal tax credits, state rebates, and utility incentives to maximize capital efficiency.

Explore Green Financing Options Calculate Your Incentive Stack

Financing Solutions for Every Green Sector

Specialized Green Energy Financing Programs

Green energy businesses have unique access to financial products that blend private capital with public support. Understanding these categories is the first step to optimizing your funding structure.

Government-Backed Programs

Tap into federally backed financing designed for sustainability. These typically offer lower rates, longer terms, and higher loan limits due to government guarantees.

- SBA Green Loans: Expedited processing for certified businesses.

- USDA REAP: Grants and guarantees for rural energy projects.

- DOE Loans: Large-scale financing for pioneering clean energy projects.

State & Regional Clean Energy Finance

These local programs understand state-specific incentives and project dynamics, offering hyper-tailored structures for regional deployment and efficiency upgrades.

- State Green Banks: Project financing in states like NY, CT, and CA.

- C-PACE Financing: Funding for property-based efficiency upgrades repaid via property taxes.

- Warehouse Lending: Contractor-focused capital for managing project pipelines.

Alternative & Impact Capital

Seek mission-aligned capital from investors focused purely on environmental and social impact, often leading to more favorable terms for truly green ventures.

- Impact Investors: Funds prioritizing ESG performance alongside returns.

- Crowdfunding: Platforms like Mosaic and Wunder Capital for clean energy projects.

- Venture Debt: Growth capital for established clean tech startups.

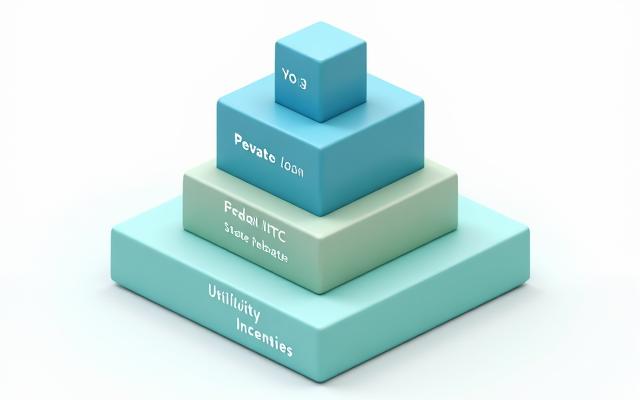

Maximizing Value Through Incentive Stacking

The primary financial advantage of the clean energy sector is the ability to stack multiple government and utility incentives with your primary financing. This strategy dramatically reduces the effective capital cost of a project, potentially reducing net costs by 30-50% or more.

Key Incentive Layers:

- Federal Tax Credits (ITC/PTC): Credits up to 30% of project costs for solar and other technologies, directly offsetting tax burden or monetized through tax equity.

- State & Local Rebates: Cash back incentives, sales tax exemptions, and property tax breaks specific to sustainable infrastructure deployment.

- Utility Programs: Revenue streams from performance-based incentives and Renewable Energy Credits (RECs), enhancing project cash flow.

Leres Nito LLC helps you strategically coordinate incentive timing and documentation to ensure your lender underwrites the total value, leading to larger, more favorable loans.

Download the Incentive Stacking Guide

Financing for Solar Installation Businesses

Capital Needs in the Solar Sector

Solar contractors face unique working capital challenges, primarily covering material costs and labor before customer or project financing payouts. Structured financing is essential for scaling quickly in a high-demand market.

- Inventory Financing: Lines of credit to purchase panels and components in bulk, securing manufacturer discounts.

- Warehouse Lines of Credit: Bridge financing for multiple concurrent projects, stabilizing cash flow during deployment cycles.

- Customer Financing Integration: Offering third-party consumer loans enhances sales by making installations affordable for residential and small commercial clients, ensuring the contractor is paid quickly.

Success Snapshot:

A reliable $200K warehouse line enabled one client to purchase panels in bulk at a 15% discount, immediately improving gross margins and allowing them to scale crews to execute a growing project backlog.

EV Charging Infrastructure Financing

Capitalizing on the rapid shift to electric mobility requires strategic financing for high-cost hardware and prime site development.

Funding Your Network Deployment

DC fast chargers can cost upwards of $100K per station before installation. We guide businesses through financing that leverages national and state stimulus funding for critical network expansion.

Key Funding Avenues:

- Equipment Financing: Dedicated loans for Level 2 and DCFC hardware, often covering up to 100% of cost.

- NEVI Funding: Navigating the federal National Electric Vehicle Infrastructure program funds, often structured as matching grants.

- Site Acquisition & Development: Commercial property loans tailored for charging site development and utility interconnection costs.

Capital for Energy Efficiency Contractors

Bridging the Project Gap

Contractors specializing in commercial building retrofits, HVAC upgrades, and energy performance contracts need reliable working capital to manage multi-month project cycles and inventory of high-efficiency equipment (like LED lighting or specialized controls).

We focus on financing solutions that stabilize your cash flow and enable you to offer attractive customer financing options, such as C-PACE or utility on-bill repayment plans, which significantly increase client acceptance rates.

Essential Funding Tools:

- C-PACE Partnering

- Enabling commercial clients to finance 100% of efficiency upgrades with long repayment terms via property taxes.

- Working Capital Lines

- Covering labor and inventory costs until large utility rebates or client performance payments are received.

- Specialized USDA Programs

- Accessing REAP funding for efficiency projects within rural business areas.

Clean Tech Manufacturing & Innovation Financing

Scaling innovation from the lab to full-scale production requires patient capital that understands high-growth technology risk and long development timelines.

Funding Trajectory from R&D to Scale

Whether you're developing advanced energy storage, EV components, or carbon capture systems, your financing needs evolve dramatically. We provide clarity on accessing capital across every stage.

Funding Solutions by Stage:

Financing for Sustainable Product & Service Businesses

From eco-friendly packaging to zero-waste consultation, non-infrastructure green companies require financing that aligns with inventory cycles and growing consumer demand.

Capitalizing on Consumer Values

Sustainable consumer brands often attract specialized impact investors. Qualification is heavily based on demonstrated market demand, supply chain transparency, and achieving key external validations like B Corp certification.

- Inventory Funding: Essential for managing global sustainable procurement and fulfilling large corporate orders.

- Revenue-Based Financing: Ideal for predictable revenue streams from subscription models or recurring services in the circular economy.

- Certification Benefits: B Corp status or environmental product declarations can open doors to lenders and funds specifically targeting mission-driven organizations.

Continue Your Green Financing Journey

Use our expert resources to solidify your capital strategy and move forward with clarity.

Exclusive Download

Access our comprehensive guide to key federal and state incentives for clean energy projects in one searchable PDF.

Federal & State Incentive Directory [PDF]Strategic Planning Guide

Learn how to prevent the five most common funding pitfalls specific to the subsidized clean energy sector.

Avoid Green Loan MistakesGet Personalized Guidance

Questions about complex incentive stacking or specialized lender requirements? Speak with a Leres Nito LLC expert.

Contact Our Green Energy Desk