Complete Guide to Business Loan Types—Find Your Perfect Financing Match

From SBA loans to merchant cash advances—understand the costs, requirements, and best uses for every financing option. Choosing the wrong type can cost you thousands in unnecessary fees and unfavorable terms. Let us demystify the options.

Business Loan Comparison Tool

Use this side-by-side comparison to quickly contrast the most important attributes of major business loan types. Remember: Leres Nito LLC offers unbiased comparisons with no lender affiliations.

| Loan Type | Interest/Factor Rate | Loan Range | Typical Terms | Approval Time | Min. Credit Score | Collateral Needs | Best For |

|---|---|---|---|---|---|---|---|

| SBA Loans ($) | 6-9% (Low) | $50K - $5M | 5 - 25 Years | 60 - 90 Days | 680+ | Required (often Real Estate/Major Assets) | Long-term capital, real estate purchase, acquisition |

| Term Loans (Medium) | 7-30% (Variable) | $25K - $500K | 1 - 5 Years | 1 - 4 Weeks | 650+ | Varies (Unsecured/Blanket Lien) | Specific, one-time expenses, inventory purchase |

| Lines of Credit (Flexible) | 10-25% (Revolving) | $10K - $250K | Revolving | 1 - 2 Weeks | 660+ | Often Unsecured | Managing seasonal cash flow fluctuations |

| Merchant Cash Advance (High Cost) | 1.2 - 1.5 Factor Rate (~20-250% APR) *Warning | $5K - $500K | 3 - 18 Months | 1 - 3 Days | 550+ | No Collateral (Daily Revenue Repayment) | Genuine emergency funding, short-term gaps |

| Equipment Financing (Secured) | 8-20% (Asset-Based) | Up to Equipment Value | 1 - 7 Years | 1 - 3 Weeks | 630+ | Equipment is the Collateral | Purchasing specific machinery or vehicles |

| Microloans (Startups/Small) | 8-13% (Community-Based) | Up to $50K | Up to 6 Years | 2 - 8 Weeks | 620+ | Varies (Often Character-Based) | Startups, initial inventory, very small business capital |

SBA Loans—Government-Backed Financing for Established Businesses

The Small Business Administration (SBA) doesn't lend money directly, but guarantees a percentage of the loan, reducing lender risk. This allows banks and financial institutions to offer lower interest rates and longer terms than almost any other product on the market.

Key Benefits

- Lowest Rates: Typically 6-9%, tied to the Prime Rate.

- Longest Terms: 5-25 years, ideal for managing cash flow longterm.

- High Amounts: Loans up to $5 million for scaling.

- Versatile Use: Real estate, heavy equipment, business acquisition, and substantial working capital.

Drawbacks & Requirements

- Lengthy Process: 60-90 days typical for full funding.

- Documentation: Requires extensive financial statements, projections, and a detailed business plan.

- Collateral: Personal guarantee and collateral are almost always required.

- Credit Profile: Requires strong credit, typically 680+ FICO.

Explore specific SBA programs, including those tailored for veteran and minority entrepreneurs, on our Special Programs page.

Term Loans—Straightforward Financing for Specific Business Needs

A term loan is a lump sum of capital borrowed and repaid over a fixed period, usually with consistent monthly or weekly payments. These are the most common loan type offered by both traditional banks and alternative online lenders.

Bank vs. Alternative Lender Comparison

| Factor | Bank Lender | Alternative Lender |

|---|---|---|

| Rates | Lower (7-15%) | Higher (15-30%) |

| Approval Time | Slower (2-4 weeks) | Faster (1-5 days) |

| Requirements | Stricter (650+ Credit, 2+ Years) | More Flexible (600+ Credit, 1+ Year) |

Best Use Cases for Term Loans:

- Purchasing substantial inventory or raw materials.

- Financing a fixed expansion project or renovation.

- Refinancing existing, high-interest business debt.

Business Lines of Credit—Flexible Funding for Cash Flow Management

A business line of credit (LOC) functions like a business credit card, but usually with lower rates and higher limits. You are approved for a maximum amount, and you only pay interest on the money you actually use. Once funds are repaid, they become available to borrow again.

LOCs are perfect for bridging gaps between accounts receivable and payable, covering unexpected repairs, or taking advantage of time-sensitive discount opportunities from suppliers.

- Typical Rates: 10-25%

- Typical Limit: $10K - $250K

- Best For: Cash flow, working capital, emergencies

Merchant Cash Advances—Fast Emergency Funding with High Costs

IMMEDIATE WARNING: High Cost

A Merchant Cash Advance (MCA) is not a true loan; it is an advance on future revenue. Because of factor rates (1.2 to 1.5), the effective Annual Percentage Rate (APR) can range from 20% all the way up to 250%.

MCAs are incredibly fast (1-3 days approval) and accessible (credit scores as low as 550 accepted) because repayment is typically automatic and tied to a percentage of your daily credit card sales or bank deposits. This makes them a viable option only for genuine, short-term emergencies where no other form of capital is available.

Why Use Caution:

- Daily payments can severely strain routine cash flow.

- The high cost means you pay back significantly more than you borrow.

- They can easily lead to a cycle of rolling debt.

Possible Alternatives:

- Secured Business Line of Credit (pre-established).

- Short-term term loans from alternative lenders.

- Invoice financing if you have outstanding receivables.

To learn more about the pitfalls of high-cost financing, reference our guide on Top Loan Application Mistakes.

Equipment Financing—Asset-Based Loans for Machinery & Vehicles

Equipment financing is specifically designed to purchase physical business assets. The key benefit is that the equipment itself serves as collateral, which makes qualification easier and often lowers the interest rate relative to an unsecured term loan.

You can finance up to 100% of the equipment value, and repayment terms (1-7 years) are generally aligned with the expected useful life of the asset.

Loan vs. Lease: Key Differences

Deciding between buying (Loan) or renting (Lease) impacts costs, taxes, and ownership. Loans give you ownership and allow access to tax write-offs like the Section 179 deduction. Leases offer lower upfront costs and easier technology upgrades.

Ideal for: Construction companies buying heavy machinery, medical practices acquiring diagnostic tools, or restaurants needing new kitchen systems. To see industry-specific examples, view our Healthcare Practice Financing Guide.

Microloans—Small Funding for Startups & Very Small Businesses

Microloans are smaller loan amounts, typically under $50,000, generally provided by nonprofit lenders, Community Development Financial Institutions (CDFIs), or the SBA Microloan program. They are designed to support startups, newer businesses, and those with limited access to traditional bank financing.

Accessibility and Support

Microloans are more forgiving on strict credit history (620+ is typical) and heavily weigh the business plan, character, and potential. Many providers include free support, such as business mentoring and technical assistance, ensuring your capital is put to effective use.

Primary Uses: Initial inventory, startup costs, minor equipment purchases, and working capital for very small operations. These loans serve as the foundational capital injection for many underserved entrepreneurs.

Explore Startup & Microloan ResourcesWhich Loan Type Is Right for Your Situation?

Find the recommended financing solution based on your specific business need.

Best Loan Types by Industry

Healthcare

Priorities: Equipment Financing for devices, SBA 7(a) for major practice expansion, Lines of Credit for seasonal patient cycles.

Healthcare Guide

Retail & E-commerce

Priorities: Inventory Financing, Lines of Credit for seasonal stocking, MCA (use cautiously) for immediate inventory needs.

Retail Loan Focus

Construction

Priorities: Equipment Financing for machinery, Lines of Credit for payroll gaps between milestones, SBA loans for long-term project bonding.

Construction Loans

Technology & Startups

Priorities: Microloans for initial funding, Convertible Notes/Venture Debt for growth stage, Term Loans for established scaling.

Startup GuideStrategic Tips for Loan Applications

Before You Apply: Key Preparation Steps

- Know Your True Cost: Always calculate the total repayment amount (including fees and origination fees), not just the quoted interest rate.

- Profile Check: Verify your credit score, time in business, and annual revenue. This instantly narrows down feasible loan types.

- Match Needs and Product: Do not use short-term, high-cost debt (like MCA) for long-term real estate investment. Match the loan term to the asset life.

- Prepare Documentation: Have 3 years of tax returns, current financial statements, and a strong business plan ready, especially for bank or SBA loans.

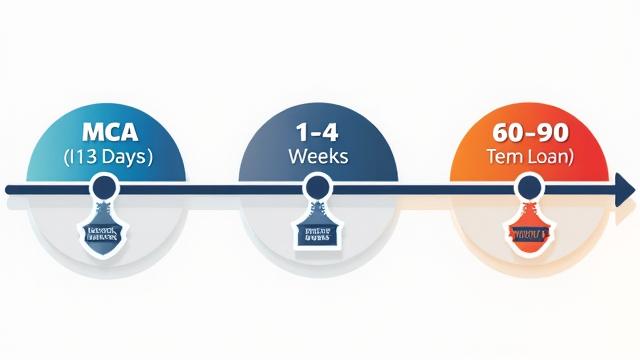

The Application Timeline Map

Plan ahead. If you need capital quickly, focus on alternative lenders or LOCs. If you can wait 60+ days, pursue the lower rates of a traditional bank or SBA loan.